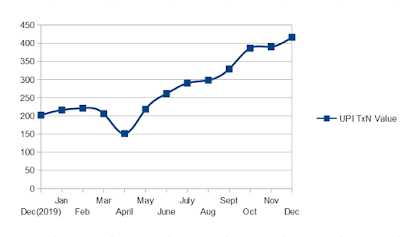

Q: The RBI and the government have become such big Deevane of UPI that they're ignoring the large number of small value frauds, will this cause problems in its international rollout?

The potential for small-value frauds within the Unified Payments Interface (UPI) system could indeed pose challenges for its international rollout. Here are some key considerations:

Impact on International Rollout

-

Trust and Credibility:

-

Trust Issues: If UPI is perceived as vulnerable to fraud, it could undermine trust among international users and stakeholders.

-

Regulatory Concerns: Countries with stringent regulatory frameworks might be cautious or hesitant to adopt UPI if they see it as having significant fraud risks.

-

-

Adoption and Usage:

-

User Reluctance: Both individual users and businesses may be reluctant to adopt UPI if fraud incidents are not effectively mitigated.

-

Competition: UPI will compete with other established and secure payment systems globally. Perceived security flaws could deter users from switching.

-

-

Partnerships:

-

Banking Partnerships: Banks and financial institutions in other countries might be hesitant to integrate UPI if it is associated with high fraud rates.

-

Merchant Adoption: Merchants may prefer other payment methods if they believe UPI transactions are prone to fraud.

-

Mitigation Strategies

To ensure a smooth international rollout, the RBI and the government could consider the following steps:

-

Enhanced Security Measures:

-

Fraud Detection Systems: Implementing advanced fraud detection and prevention mechanisms can help reduce small-value fraud incidents.

-

User Education: Educating users about potential fraud risks and safe practices can help mitigate fraud.

-

-

Transparency and Communication:

-

Transparency: Providing clear communication about the measures taken to address fraud can build trust among potential users and stakeholders.

-

Reporting: Regularly publishing data on fraud incidents and the steps taken to combat them can demonstrate commitment to security.

-

-

Collaboration:

-

Global Standards: Adopting and adhering to international security standards for digital payments can enhance UPI's credibility.

-

Partnerships: Collaborating with global security experts and institutions can help improve the overall security of the UPI system.

-

Conclusion

While the RBI and the government have successfully promoted UPI within India, addressing small-value fraud is crucial for its international acceptance. By implementing robust security measures and maintaining transparency, they can mitigate the risks and ensure a successful global rollout.

.jpg)